Banking is not just a business; it’s a community.

Bankers, like yourself, have a unique understanding of the industry’s challenges and opportunities. It’s this intimate knowledge of the banking world that led me to create BANK MONITOR – a service that’s built by a banker, for fellow bankers to streamline social media compliance.

I spent over two decades in the banking industry, working directly in roles related to bank marketing and social media. It was during this time that I recognized the critical need for a comprehensive solution to keep banks in compliance with the FFIEC Guidance from 2013. I personally faced the challenges of managing social media while ensuring compliance, and that firsthand experience drove me to create BANK MONITOR.

So, why should you trust BANK MONITOR for your social media compliance? Here are a few key reasons:

- Experience: I know what it’s like to be in your shoes. I’ve been responsible for bank marketing and social media, and I understand the unique challenges you face.

- 24/7 Monitoring: BANK MONITOR is the result of my dedication to creating a turnkey solution that works even outside of business hours. We monitor your social media activity round the clock, ensuring you’re always covered.

- Affordability: BANK MONITOR is priced at just $750.00 per month, making it an affordable choice for community banks seeking peace of mind. We believe that compliance shouldn’t break the bank.

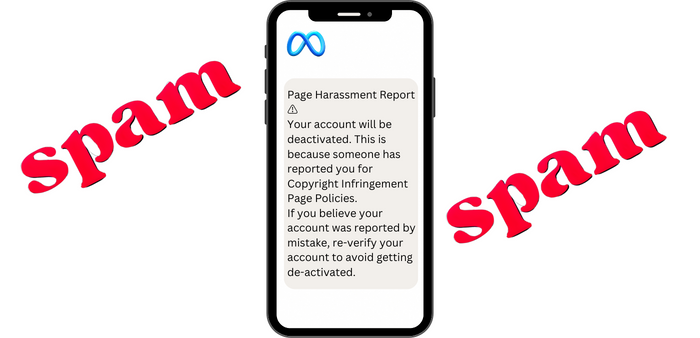

- Immediate Action: Unlike other services, BANK MONITOR goes beyond monitoring and offers immediate action. We’re notified within minutes if any regulation violations, inappropriate verbiage, Personally Identifiable Information (PII), or malicious links are detected, and we can take down posts even before human review.

- Personal Commitment: As the creator of BANK MONITOR, my commitment to you is personal. I’ve walked in your shoes, and I’ve felt the weight of responsibility for social media compliance. BANK MONITOR is my way of ensuring that no banker faces these challenges alone. When you choose us, you’re not just a client; you’re a part of our banking community.

When you trust BANK MONITOR, you’re not just choosing a compliance solution; you’re choosing a partner who understands your needs, values your time, and shares your commitment to excellence. With BANK MONITOR, you can have the peace of mind that your social media presence is not just in compliance but thriving in the digital age of banking.

Join us in this journey of making compliance effortless and social media management a breeze. Let’s work together to ensure your bank’s success in an ever-changing landscape. Choose BANK MONITOR, and rest easy, knowing you have a trusted advisor and fellow banker by your side.

To learn more about how BANK MONITOR can transform your social media compliance, feel free to get in touch with us. We’re here to help you succeed.

Thank you for considering BANK MONITOR as your partner in social media compliance. Together, we’ll navigate the complexities of the banking world and emerge stronger and more compliant than ever.